Shifting Perspectives on the Dual Mandate

Historical Evolution

Via its 1977 Amendment to the Federal Reserve Act, the United States Congress instructs our nation’s central bank to conduct monetary policy “so as to promote effectively the goals of maximum employment, stable prices, and moderate long term interest rates.” Although these are the words most often cited as the source of the “dual mandate” requiring Federal Reserve officials to focus on both unemployment and inflation when setting interest rates and regulating the money supply, Steelman (2011) traces all the way back to the Employment Act of 1946 the more general idea that US economic policies, including those of the Fed, ought to be directed towards achieving objectives for those two variables jointly.

Sargent’s (1999) historical analysis, however, describes how the Federal Reserve’s own interpretation as to exactly how its dual mandate is to be fulfilled has evolved considerably over the decades. During the 1960s and 1970s, policymakers viewed the Phillips curve – the inverse statistical relationship between unemployment and inflation often found in data from the US and other economies – as offering a menu of possible outcomes from which they could choose, through skillful fine tuning, exactly the right mix of employment and stable prices. This view was shattered, however, when by the late 1970s, those same policymakers were forced to “adaptively learn” about the natural rate hypothesis developed ten years earlier by Phelps (1967), Friedman (1968), and Lucas (1972), which emphasized the role of changing expectations of inflation in destabilizing the Phillips curve and reduced the exploitable trade off between unemployment and inflation to a highly transient one, at best.

Sargent’s (1999) mathematical and statistical analyses focus, more specifically, on the question of whether policymakers changed their beliefs because they were truly persuaded by the power of Phelps, Friedman, and Lucas’ theoretical arguments or whether, as empiricists, they simply stopped trying to exploit the Phillips curve when their efforts to lower the rate of unemployment by increasing the rate of money growth brought little or nothing in terms of job gains and led mainly to higher inflation. Most of Sargent’s results favor the latter, empirically oriented explanation, pointing, in his words, to the “vindication of econometric policy evaluation” instead of the “triumph of natural-rate theory.” But whatever the reasons for the Fed’s shift in emphasis might have been at the time, it seems clear in retrospect that the elevation of price stability above maximum employment on their list of priorities was key, in the early 1980s, to the success that policymakers had in bringing inflation down from its peak and restoring stability and vigor to the American labor market as well.

Nor can it be disputed that the natural rate hypothesis guided the design of the inflation targeting strategies developed and implemented by central banks around the world since 1990. Recognizing, as Phelps, Friedman, and Lucas did two decades before, that there is little that monetary policy can do to push unemployment below its natural, or normal, rate, and acknowledging as well the costs that higher inflation imposes on the economy, inflation targeting strategies focus first and foremost on stabilizing prices around pre-announced targets and thereby also provide ideal conditions for long-run growth in income, spending, and employment.

Thus, as Bernanke et al (1999) emphasize, inflation targeting strategies fully reflect the monetary lessons learned from the 1970s era of stagflation, while remaining consistent with both sides of the dual mandate as well. The single most effective way that the Fed can “promote the goal of maximum employment” is to stabilize prices. This simple truth is why, in their 1999 volume, Chairman Bernanke and his co-authors could so readily cite numerous examples of countries in which macroeconomic performance improved, across the board, once the strategy of inflation targeting was adopted and put into action. And this is why the Federal Reserve’s own announcement, in January 2012, setting an explicit, two percent target for long-run inflation in the United States, represents such a giant step forward. That announcement, all at once, recognized the scientific genius of three Nobel Prize-winning economists, promised that the mistakes of the 1970s would never be repeated, and offered reassurances that Federal Reserve policymakers, unshaken by crisis and recession, stood with clear minds and steady hands, fully deserving of the American people’s trust and respect.

Recent Developments

Most recently – and less than a year after it took the all-important step of quantifying its objectives for inflation – the Federal Reserve has again referred specifically to unemployment in its policy statements, intended to offer “forward guidance” to the public about the future path of its federal funds rate target. These statements not only make clear that Federal Reserve policymakers are basing their decisions partly on the behavior of unemployment but, much more worrisome, also suggest that they are doing so with a specific, numerical target for the unemployment rate in mind. In the press release that followed their December 2012 meeting, members of the Federal Open Market Committee announced their intention to keep the federal funds rate within its exceptionally low band, between 0 and 1/4 percent, so “long as the unemployment rate remains above 6 1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored.” This language has remained, consistently, in FOMC policy statements ever since then.

As Orphanides (2013) quite rightly points out, these FOMC statements are carefully worded in a way that makes it impossible to rule out that they remain consistent with a broader strategy of inflation targeting. Svensson (1999), in particular, defines and discusses a form of “flexible inflation targeting” under which the central bank allows inflation to return to target only gradually after the economy is hit by a shock, in order to smooth out the paths of output and employment as well. FOMC members’ desire to see the unemployment rate decrease, conditional on inflation not wandering too far away from two percent, might very well describe a policy of flexible inflation targeting in practice.

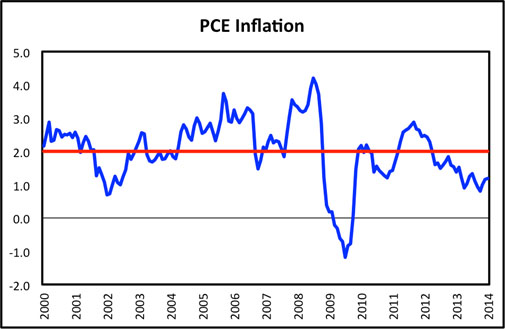

Nevertheless, the recent language raises two sets of concerns. First, the disturbances that have hit the economy recently lack the distinguishing features of the sort of “cost-push” shocks that, as Clarida, Gali, and Gertler (1999) show, give rise to a painful trade off when trying to stabilize both unemployment and inflation. Shocks of that kind, though they do act to increase unemployment, also work to increase inflation. But, as figure 1 at the end of this paper shows, the sluggish recovery experienced in the United States since the middle of 2009 has been accompanied by inflation rates that have remained, quite consistently, below the Fed’s two percent target. Any policy of inflation targeting – strict or flexible – would view bringing inflation back to two percent as quickly as possible as the first priority for Federal Reserve officials today. The additional reference to unemployment, especially to a numerical target for unemployment, seems wholly unnecessary.

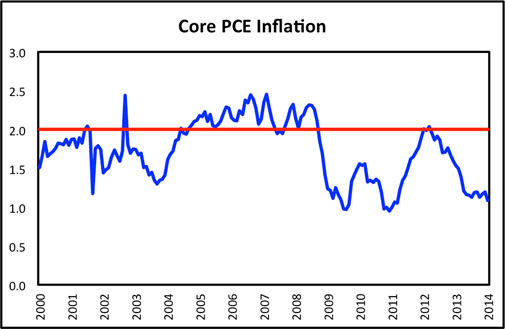

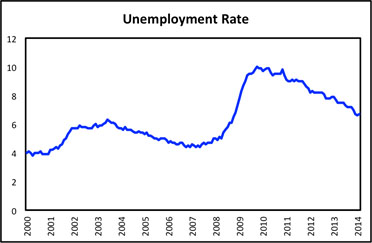

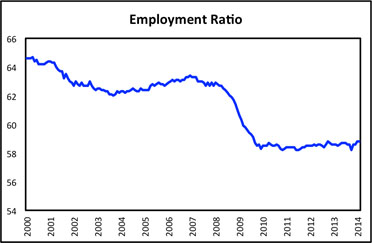

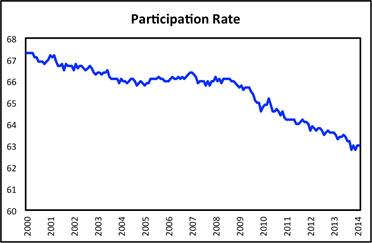

Second, the recent behavior of the unemployment rate itself ought to be enough to remind anyone who has temporarily forgotten the painful lessons of the 1970s of why setting specific unemployment targets for monetary policy is not only redundant but potentially quite harmful. The top panel of figure 2 confirms what we all know from the business headlines: over the period of slightly more than a year since the FOMC announced its 6 1/2 percent target, the US unemployment rate has fallen from 7.9 to 6.7 percent. If one were to take the Fed at its word, and these data at face value, one would have to conclude that the FOMC’s goals for unemployment have been almost entirely achieved, and that the time to start raising the federal funds rate might soon be at hand. Except, as the middle panel shows, the employment ratio – defined as the number of people who actually have jobs as a percentage of the total adult population – has hardly budged over the last year and, as a matter of fact, has yet to recover any of the ground lost since the 2007-09 recession.

Algebraically, when all variables are expressed as fractions instead of percentages, the unemployment rate equals one minus the employment ratio divided by the labor force participation rate. In general, this means that when the unemployment rate falls, it can be because the employment ratio rises, the labor force participation rate falls, or some combination of the two. But what the three panels of figure 2 show together is that, in fact, the decline in the unemployment rate from its 2009 peak is due in its entirety to a decline in the labor force participation rate, a trend that began before, but accelerated noticeably during, the Great Recession and that is still quite far from being well-understood.

It is vital to sidestep this pitfall, which is the same one that the Fed fell into during the 1970s, when it also focused too closely on unemployment. It is crucial to re-acknowledge that the unemployment rate is just too poorly measured, too poorly understood, and is buffeted about by too many factors beyond Federal Reserve’s influence to make it a reliable guide for monetary policy. Many FOMC members are rightly concerned that it makes no sense to tighten monetary policy just because the labor force participation rate has fallen. Yet, if they live to up their words, that is exactly what they will be forced into doing. And if they back off, the disconnect between their words and their actions will stir up precisely the kind of public confusion that forward guidance was supposed to avoid.

The message from the latest data rings loud and clear: numerical targets for unemployment don’t work. The Fed can and should care about unemployment. It can and should aim to fulfill its dual mandate. But theory and history, distant and more recent, all tell us that the best way to stabilize unemployment is to stabilize prices first.

Looking Ahead

Of course, successfully implementing a strategy of inflation targeting is much easier said than done. A major practical problem in directing monetary policy towards stabilizing prices lies in the “long and variable lags” that Friedman (1960) famously associated with the effects of monetary policy actions on the economy as a whole. Viewed in light of these lags – which Belongia and Ireland (2013) show have become even longer in recent years than they were in Friedman and Schwartz’s (1963) time – the sluggish inflation experienced in the United States since 2008 might be a stronger reflection of excessively tight monetary policy in years past than a signal that monetary policy is insufficiently accommodative today. To guard against this possibility, we need a cross check. And here, too, Milton Friedman’s (1960, 1968) writings are useful references, since they explain exactly how and why, within his program for monetary stability, measures of the money supply serve importantly as real-time indicators of the current stance of monetary policy.

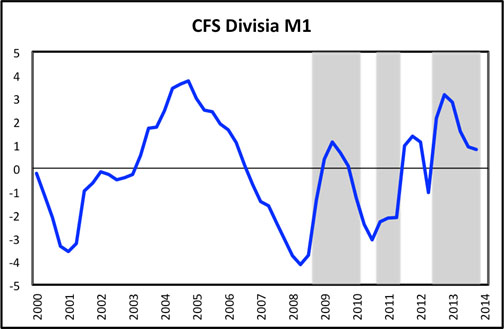

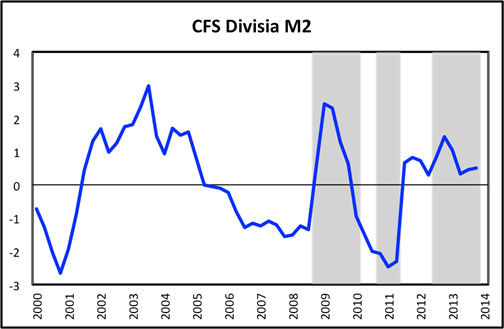

Following up on this idea, figure 3 plots the Divisia M1 and M2 monetary aggregates prepared by William Barnett and his associates at the Center for Financial Stability. As Barnett (2012) explains in detail, unlike the Fed’s own “simple-sum” measures, which just add up the dollar value of funds held in the form of different monetary assets such as NOW accounts and small time deposits, Divisia aggregates weight each asset in the group in proportion to the “monetary services” that it provides. The Divisia aggregates are, therefore, more in tune with economic theory and, no doubt as a consequence, more reliable when used in empirical analyses of monetary policy and its effects. Here, both series are passed through the Hodrick-Prescott (1997) filter in order to isolate their cyclical components, which Belongia and Ireland (2013) show are tightly linked to subsequent movements in output and prices.

Most notably, both measures of money strongly suggest that monetary policy moved from being overly expansionary to excessively tight over the period extending from 2003 to 2008. That long swing in money was followed by a similar swing in output – the whole episode strongly reminiscent of the monetary business cycles described by Friedman and Schwartz (1963) long ago. The graphs in figure 3 also suggest that after easing, appropriately, during the recession itself, the Fed pulled back too soon, leading to a marked deceleration in money growth in the early stages of the recovery. The monetary aggregates, therefore, shed new light on the sluggish inflation experienced since then, pointing to continued monetary policy instability as a cause, in itself, not only for that low inflation but for some of the slow growth in output and employment experienced since then as well.

Recently, however, growth in the Divisia monetary aggregates has resumed and stabilized. This observation lends support to the consensus view, widely held both inside and outside the Fed, that inflation ought soon to begin returning to the two percent target. These data lend support, as well, to the view that the Fed can safely continue in scaling back on its enormous bond-buying programs.

At present, however, neither measure of money in figure 3 suggests that there is a great danger than inflation will overshoot its target. Rather, the feeling one gets from looking at these graphs is one of cautious optimism. Monetary policy seems supportive of an accelerating recovery. Yet risks still lie on both sides. Accordingly, policymakers should stand ready to act in either direction, as new information dictates, tapering more quickly if money growth picks up and halting or even reversing course if money growth falls once again.

One final message can be gleaned from the two panels in figure 3, which shade in the three periods of “quantitative easing” by the Federal Reserve. As Meltzer (2013) notes, one of the most troubling aspects of Federal Reserve policy in the aftermath of the financial crisis is how the explosive growth in bank reserves brought about by the Fed’s Large Scale Asset Purchase programs has failed to translate reliably into changes in the growth rate of the broader monetary aggregates. Part of the problem, as Meltzer (2013) also suggests, may be due to the Fed’s willingness to pay interest on reserves at a rate that exceeds what banks can earn on other assets, such as US Treasury bills, with similar risk and liquidity characteristics. A renewed focus by the Fed, not only on stabilizing prices but also on stabilizing the growth of nominal variables more generally, would be a welcome development and might help greatly in achieving both sides of the dual mandate.

Postscript: The Glass is at Least Half Full

The shockingly low labor force participation rate shown in figure 2 is but one of many signs of the tremendous degree of resource underutilization that characterizes the American economy today. Years of sub-par growth in income and spending and stories of large corporations sitting on gigantic piles of unspent cash, hesitant to fund potentially lucrative investment projects, are other manifestations of the same.

As troubling as these signs may appear to us now, however, they also imply that a powerful growth force lies within the US economy, dormant but ready to be tapped. For all the talk, lately, of “secular stagnation,” it may be more useful to point out that there is no reason why the United States could not, starting this very moment, to enjoy a decade or more of impressive growth that rivals or perhaps even exceeds what we saw during the 1990s, since a lot of it would simply be catch-up for all that’s been missed since 2008.

American politicians need to give up the petty squabbles, bitter acrimony, and inane parliamentary maneuverings that have poisoned and paralyzed policy discussions and debates in recent years. This behavior is unbecoming of leaders of the mightiest and most prosperous nation the world has ever seen and, besides, sets a terrible example for everyone else. A re-reading and discussion of President Washington’s Farewell Address might help get things moving in the right direction again. And, after that, a few modest, reasonable moves towards reforming and rationalizing our tax and regulatory codes and resolving some of the enormous uncertainties that surround the federal retirement and health care programs would start to build confidence in the power of compromise and – let’s face it – would help much, much more than anything the Fed can do to reignite growth in the American economy.

Figure 1. Measures of Inflation

Inflation, as measured by year-over-year percentage changes in the deflator for personal consumption expenditures and the deflator for PCE excluding food and energy, continues to run well below the Fed’s two percent long-run inflation target.

Figure 2. Labor Market Variables

The decline in the unemployment rate reflects a decline in labor force participation; the fraction of the population with jobs has not recovered at all.

Figure 3. Divisia Monetary Aggregates

The cyclical components of the Divisia M1 and M2 monetary aggregates, computed with the Hodrick-Prescott filter, suggest that monetary policy is now lending its support to the economic recovery and that inflation should soon begin returning to its two percent target. Troublingly, however, fluctuations in broad money growth seem, at best, to be loosely associated with the Fed’s three waves of quantitative easing, corresponding to the shaded areas in the graphs.

Peter Ireland is a professor of economics at Boston College and a member of the Shadow Open Market Committee.

Are you interested in supporting the Manhattan Institute’s public-interest research and journalism? As a 501(c)(3) nonprofit, donations in support of MI and its scholars’ work are fully tax-deductible as provided by law (EIN #13-2912529).